California Sales Tax By Zip Code

California City & County Sales & Use Tax Rates

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

https://www.cdtfa.ca.gov/taxes-and-fees/sales-use-tax-rates.htm

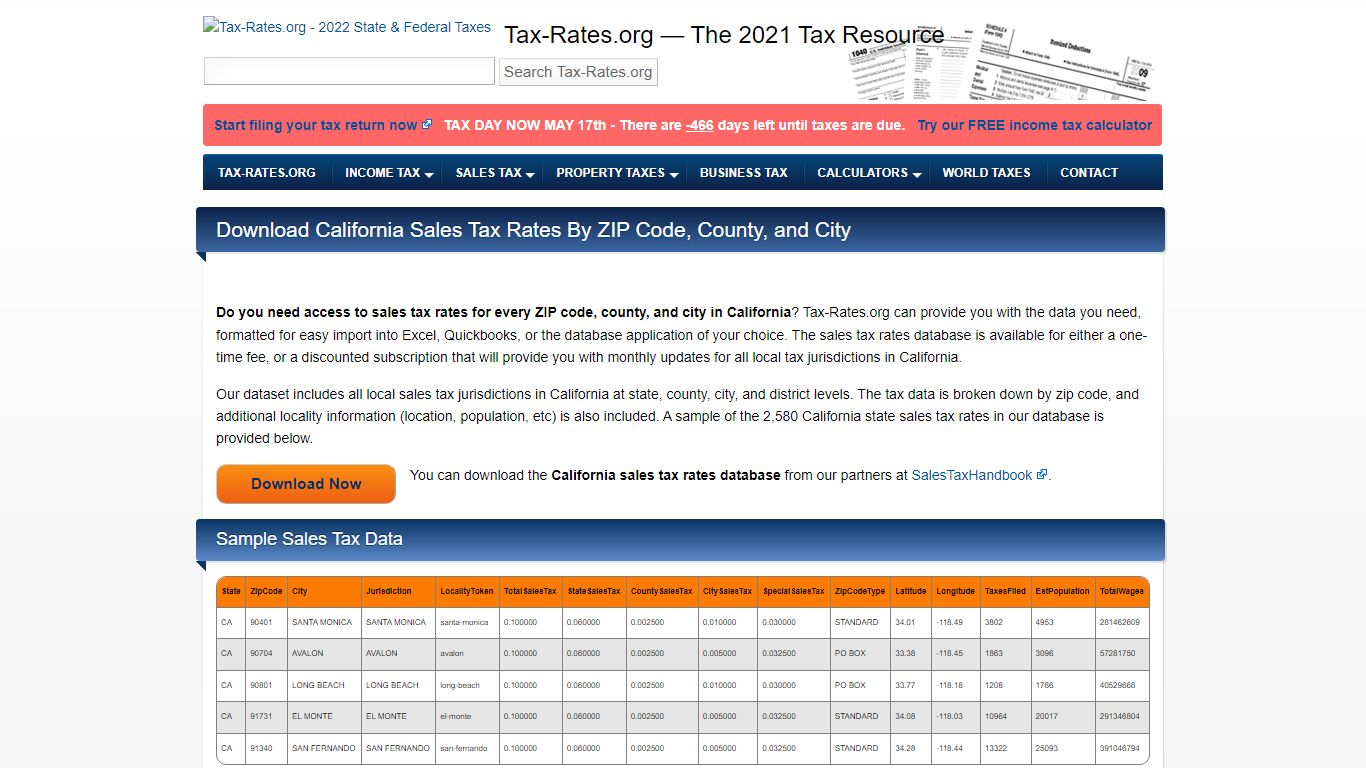

Download California Sales Tax Rates By County & Zip Code

Our dataset includes all local sales tax jurisdictions in California at state, county, city, and district levels. The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. A sample of the 2,580 California state sales tax rates in our database is provided below.

https://www.tax-rates.org/california/sales-tax-data

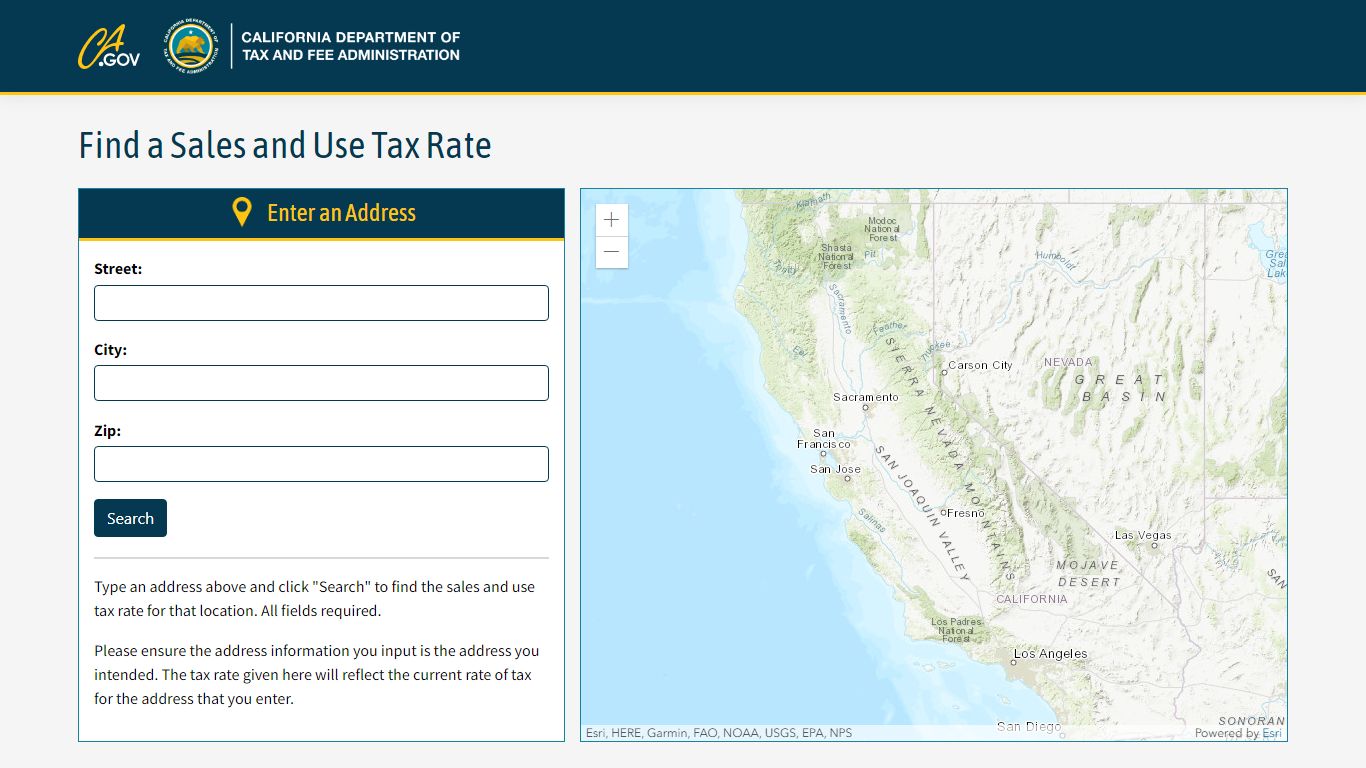

Find a Sales and Use Tax Rate - California

Find a Sales and Use Tax Rate Type an address above and click "Search" to find the sales and use tax rate for that location. All fields required. Please ensure the address information you input is the address you intended. The tax rate given here will reflect the current rate of tax for the address that you enter.

https://maps.cdtfa.ca.gov/

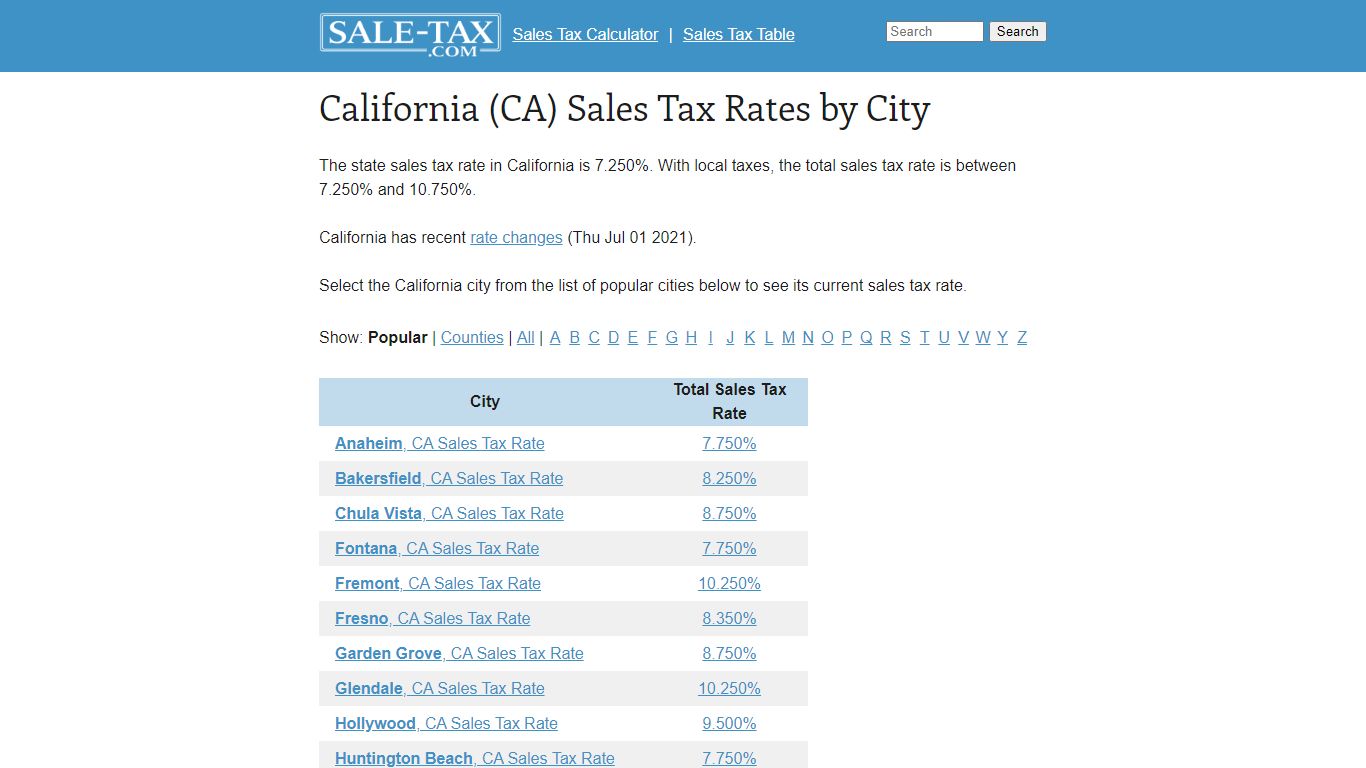

California (CA) Sales Tax Rates by City - Sale-tax.com

California (CA) Sales Tax Rates by City The state sales tax rate in California is 7.250%. With local taxes, the total sales tax rate is between 7.250% and 10.750%. California has recent rate changes (Thu Jul 01 2021). Select the California city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/California

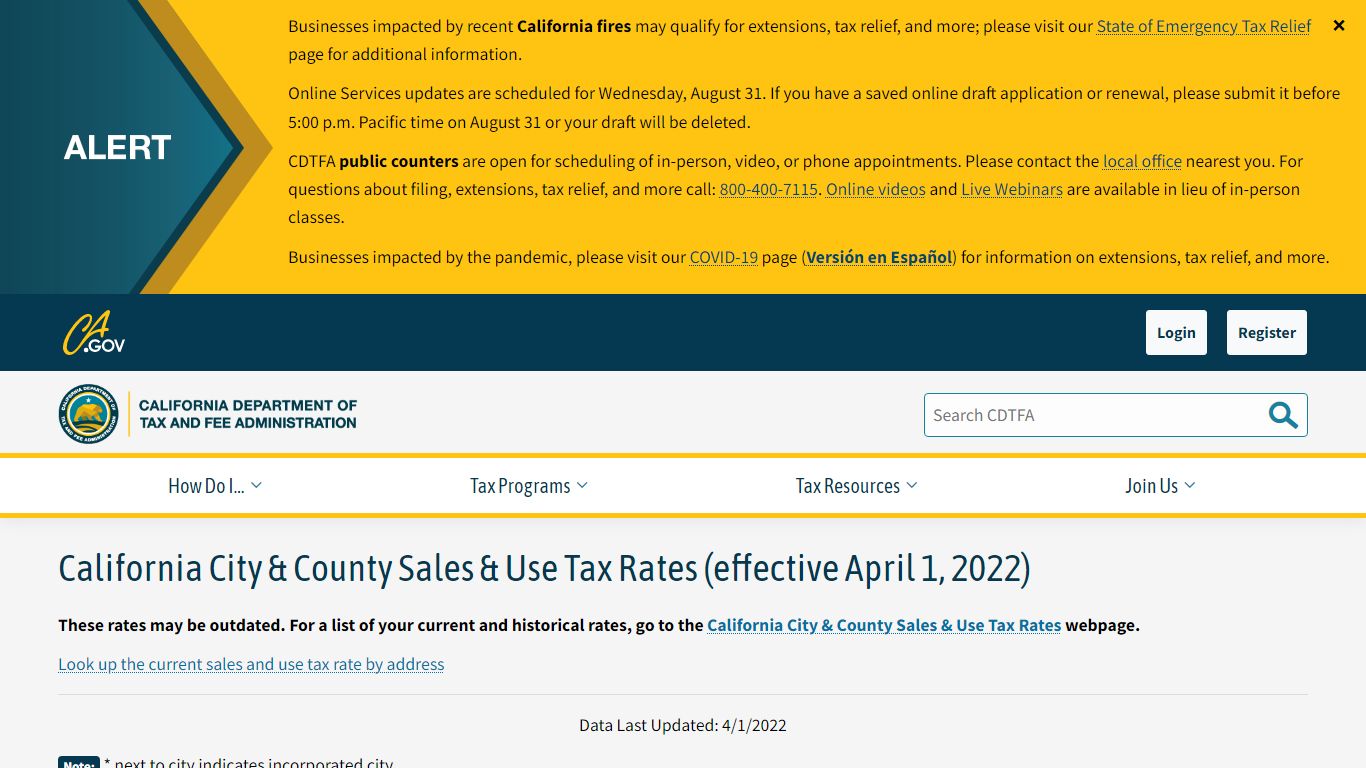

California City and County Sales and Use Tax Rates - CDTFA

California City & County Sales & Use Tax Rates (effective April 1, 2022) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by address Data Last Updated: 4/1/2022

http://cdtfa.ca.gov/taxes-and-fees/rates.aspx

Know Your Sales and Use Tax Rate - California

A base sales and use tax rate of 7.25 percent is applied statewide. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas consist of both counties and cities. There may also be more than one district tax in effect in a specific location.

https://www.cdtfa.ca.gov/taxes-and-fees/know-your-rate.htm

California Sales Tax Rates By City & County 2022 - SalesTaxHandbook

California has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 3.5%. There are a total of 469 local tax jurisdictions across the state, collecting an average local tax of 2.613%. Click here for a larger sales tax map, or here for a sales tax table .

https://www.salestaxhandbook.com/california/rates

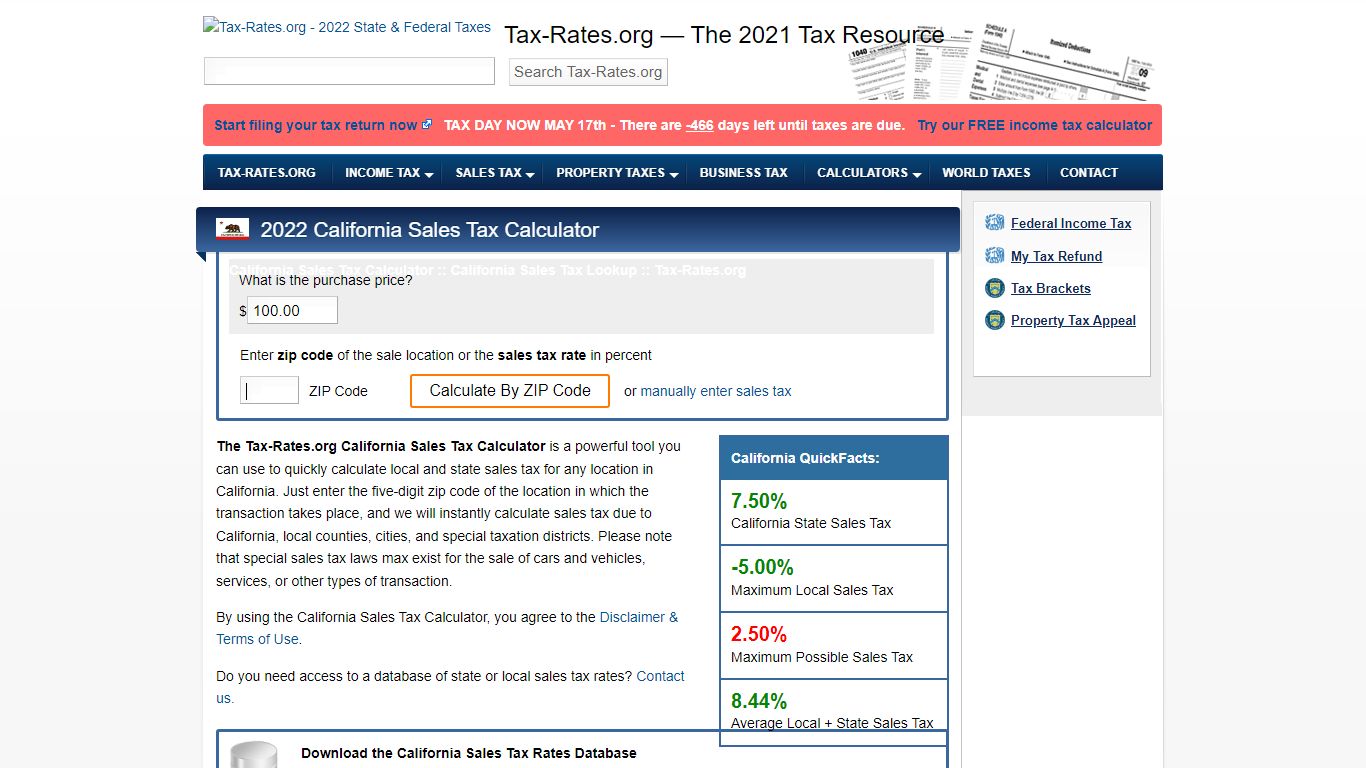

California Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to California, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/california/sales-tax-calculator

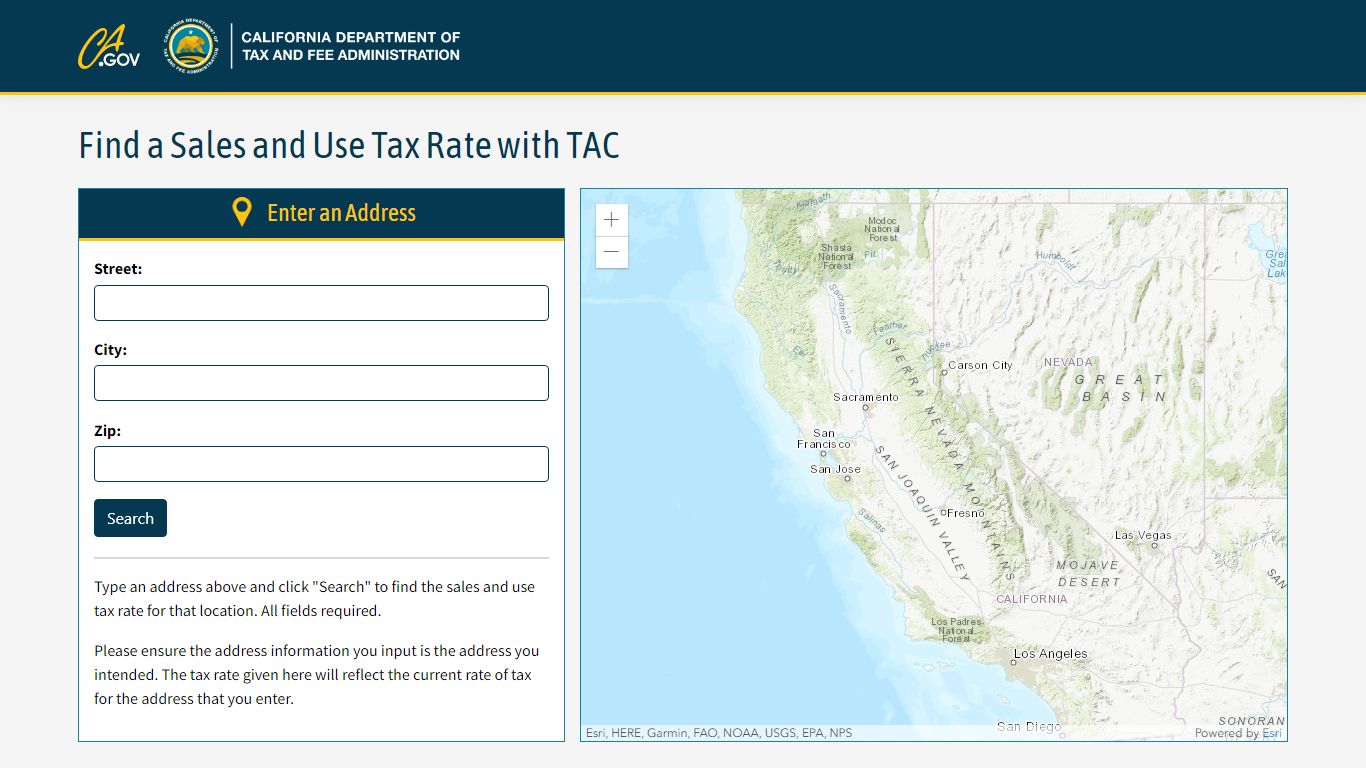

Find a Sales and Use Tax Rate with TAC - California

Find a Sales and Use Tax Rate with TAC Type an address above and click "Search" to find the sales and use tax rate for that location. All fields required. Please ensure the address information you input is the address you intended. The tax rate given here will reflect the current rate of tax for the address that you enter.

https://maps.cdtfa.ca.gov/withtac/

Sales & Use Tax in California

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate, and any district tax rate that may be in effect. State sales and use taxes provide revenue to the state's General Fund, to cities and counties through specific state fund allocations, and to other local jurisdictions.

http://cdtfa.ca.gov/taxes-and-fees/sutprograms.htm